Introducing China’s Social Credit System + the Opportunities & Threats for Businesses Based In or Expanding Into China

The social credit system in China is a database designed to keep up-to-date information on the behavior of individuals, businesses, and government entities across the country. Similar to the way citizens in most countries have a credit score that indicates their level of financial savvy and the degree to which lenders can trust them, the social credit system is attempting to capture information on an all-encompassing set of their citizens’ behaviors to develop an advanced reputation-based system.

For business owners who currently operate in China or are looking at the possibility of expanding into China in the future, it is important to have an extensive understanding of the social credit system and the implications it can have on the success of a company. Specifically, understanding the regulations which govern China’s social credit system allow business owners to ensure compliance with both legal and social standards.

Unparalleled by social movements in other countries, China’s social credit system is widely considered to be an initiative that has the potential to be revolutionary in terms of its impact on the international business landscape. At its best, the system has the potential to be a platform that can monitor individual, corporate, and government behavior in real-time.

At the present moment in late 2020, participating in either private or government iterations of this social credit system is voluntary and up to the individual/business. In the future, however, participating in the official social credit system will become mandatory. Additionally, for citizens and businesses that have already agreed to take part in the system, the rewards and repercussions have already started to come to light.

Below, we break down the potential opportunities and challenges presented by the Chinese social credit system and the implications it may have on businesses operating in the country.

1. Although it originated on a regional level in 2009, China’s social credit system was officially announced in 2014 as a pilot program co-operated by the government and eight Chinese credit-scoring firms. As the system is still being worked on before being mandated across the country, the Chinese government is aiming to produce a fully functional system that enables the ranking of all Chinese citizens and businesses in the near future.

2. Corporations are currently being measured on the basis of how well they comply with the legal business standards, in addition to being subject to a comprehensive audit of their transactions and financial records. The majority of businesses in China have already been accepted into the social credit system and given a score, with numerous companies having already been blacklisted socially due to failure to comply with certain criteria stated in the social credit score guidelines.

3. The system is currently in the process of being implemented on a federal level, so there are still some regional variations. In certain sectors, local governments base scores on data being provided by private tech firms. In others, city councils oversee the system and have more direct control over the scores.

4. In addition to overseeing business practices, China’s social credit system has the ability to monitor and control the behavior of the country’s individuals as well. From the standpoint of an individual citizen in China, one is either rewarded or punished based on the merit of their social credit scores, with the scores having the potential to increase or decrease based on their daily behavior.

We strongly advise foreign companies to seek assistance from an established local expert who can look at the specific goals and operational tendencies of a company to make recommendations on the best practices for ensuring full compliance. While companies expanding into new markets will often look for areas to cut costs, this is not such an area. It is extremely important to partner with a local organization or expert individual who can provide advice on increasing the scores of both the business and employees to prevent them from being lowered or ultimately blacklisted.

Often referred to as “China’s Ranking System”, the social credit system works with large tech companies to leverage their data sets in effort to monitor and assess the trustworthiness of its citizens and businesses. The goal of this program is, ideally, to create a highly-trustworthy society with a foundation based on both citizens and corporations following the law to the fullest extent. It’s important to know that there are unique social credit systems for individuals, businesses, and government officials.

The idea behind assigning social credit scores to members of China’s society is to give the people the ability to make more informed decisions about the parties with whom they decide to enter into business relationships. With this system in place, there is the hope that corporations and individuals operating in a trustworthy manner will be rewarded in society, while those navigating in a toxic or parasitic manner will be punished or blacklisted for their transgressions.

On a citizen level, the social credit scoring system works in a similar fashion as the process of obtaining a credit score in other countries. Due to the fact that there is often very limited information available to Chinese banks on the trustworthiness of a potential individual lender, the social credit system aims to create an enhanced method of judging whether or not an person is trustworthy enough to be provided with a loan.

A large part of the China social credit system is to track the individual’s compliance with local laws. If someone commits a legal violation in China, that information will automatically be factored into their social credit score, and can negatively impact his or her ability to secure a new job or be approved for a loan. Moving forward, the system is expected to expand the parameters of what factors it tracks.

It’s important to keep in mind that all employees of a given company based in China will be subject to the social credit system.

From a business standpoint, the social credit system focuses more on a business’s ability to comply with local regulations and pay their taxes in a timely and ethical manner. Additionally, the quality of a business’s products and/or services will be factored into their overall score.

One of the most important elements of the China social credit system for businesses to understand is the way that the scores are assigned. The system is designed to collect, aggregate, and analyze extensive data on the individual or corporation of which it is analyzing, and assign a score that provides the most accurate representation of the party in question. In order for this system to work, businesses are required to collect data on their own operations and submit the information to local and national governmental authorities. The data is then stored in a centralized database and factored into the business’s score.

The following factors are used by the Chinese government when calculating a social credit score for a business:

- If the company has consistently paid their taxes on time

- Whether the business acquires and maintains necessary licenses

- If the organization in question is compliant with relevant environmental-protection requirements

- Whether the quality of the business’s products or service meet the national standards.

- If the corporation consistently meets specific industry requirements.

Additionally, businesses are also judged on the quality and behaviors of other companies with whom they have strategic partnerships. Because of this, business owners must be very cautious with the people or organizations they choose to do business with.

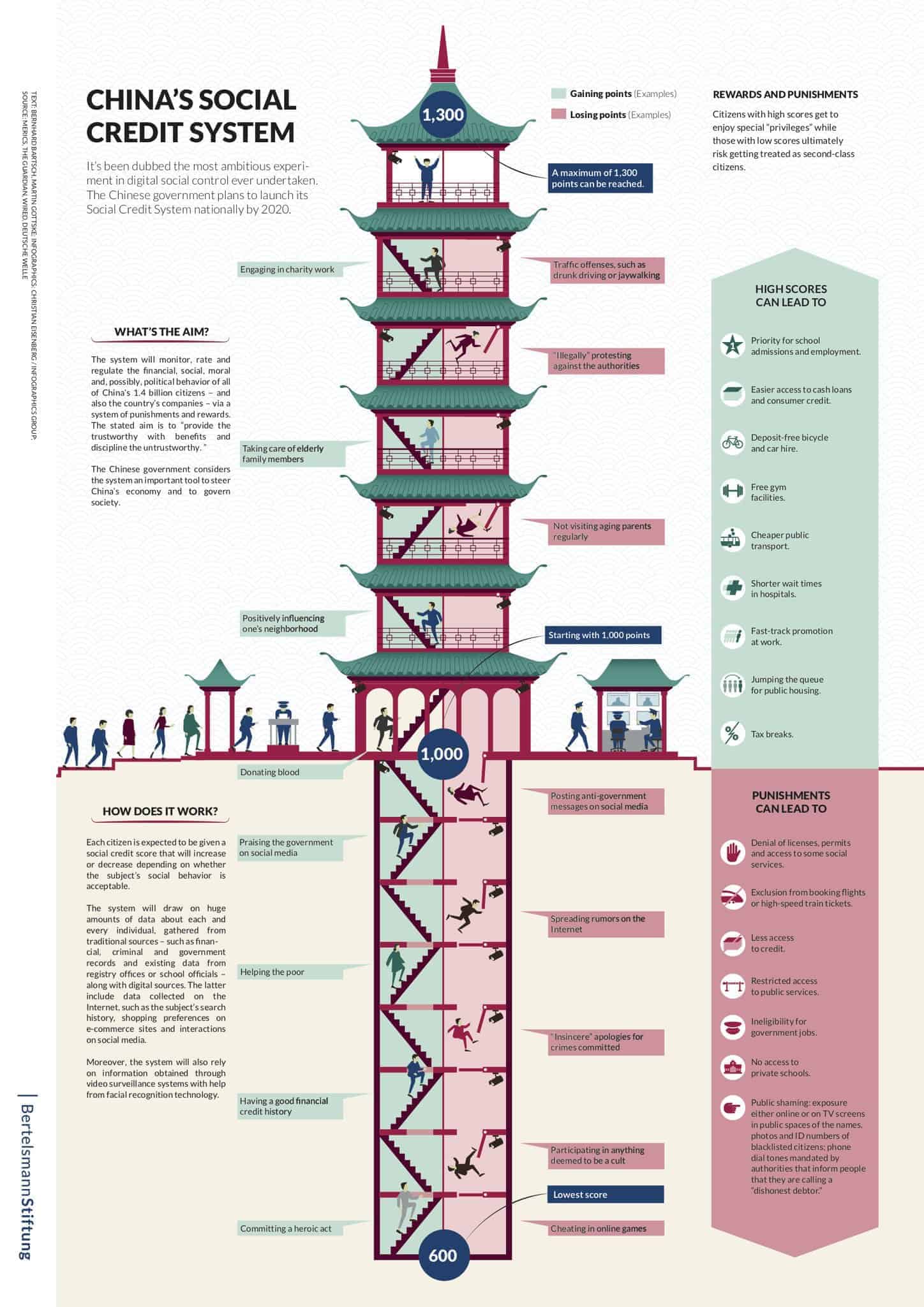

Take a look at the graphic below for examples of actions and behaviors that will lead to the growth or decline of one’s social credit score.

For both businesses and individuals, there are large opportunities and massive consequences to be had depending on one’s actions. While the exact criteria on what can move someone’s ranking in either a negative or positive direction is kept secret by the Chinese government, there is much speculation on the factors that can be to the detriment of a person’s score.

Take a look at some of the potential rewards and repercussions of China’s social credit system:

Rewards:

- Companies with a high social credit score are said to be placed on a “red list” which grants them with a variety of benefits.

- Organizations on the “red list” can gain access to streamlined administrative procedures, including certifications that can allow them to receive faster customs clearance and faster processing on tax returns.

- These businesses will also receive far fewer business inspections and audits, leaving them with the ability to operate their business more freely. They will also receive fast-tracked approvals on permit and certification requests that businesses with lower credit scores do not have access to.

Punishments:

Below are some of the potential repercussions of earning a bad social credit score:

Job bans – As an individual, doing something that will elicit a bad score can mean that the person may potentially be denied the legal opportunity to be hired to work in a large bank or be considered for a job in an executive role. On a corporate level, businesses may be excluded from being able to take part in public procurement projects.

Public shaming – The Chinese local and national governments maintain a public list of citizens and businesses who possess a poor social credit score. With this information being available to the public, it can become especially challenging for businesses with bad scores to build professional relationships in their community.

Travel bans – Citizens may be banned from flying domestically or boarding a train, with some hotels also banning people with lower social credit scores.

School bans – Citizens with poor scores may be barred from enrolling themselves in hiring education programs, or enrolling their children in certain schools.

Increased frequency of inspections – Businesses that possess lower scores can be subject to more frequent audits and government inspections than their higher-scoring counterparts.

Decreased internet speeds – An individual or business’s internet speeds may be throttled on the basis of poor online behavior.

It’s important to note that poor social credit scores can have a negative rollover effect – businesses and individuals with low scores can have a negative impact on other businesses or people with whom they form professional partnerships.

Presently, there are various national and regional violations that will result in the blacklisting of an individual or business in China. The process of blacklisting in China is directly correlated with the nation’s social credit system, with local parties being subject to a blacklist due to a specific violation or an egregiously low credit score.

In 2016, a Chinese government notice encouraged business owners to consult the federal blacklist before hiring a new employee. The list is expected to gain cultural relevance in the coming years.

It’s important to note that businesses will not be automatically placed on the blacklist in cases of failed compliance. The corporate social credit system contains an “Irregularity List” which documents issues of non-compliance that are not yet on the blacklist level. Businesses who find themselves on this list must immediately begin taking steps to improve their reputation to avoid reaching the Blacklist in the near future.

The social credit system remains a core piece of China’s vision to create a revolutionary system for monitoring its civilians and businesses while minimizing the limitations of its government. Much like any system implemented by a nation’s federal government, China believes that their social credit system has significant potential to grow their economy.

The idea behind the social credit system is to create a self-regulating marketplace, which allows authorities to maximize their control with increasingly strict government oversight and administrative processes. While this system will provide obvious challenges to businesses operating in or expanding into China, it also presents unique opportunities for foreign companies .

In many countries, federal governments create legislation to significantly boost opportunities for local companies and make it especially challenging for foreign businesses entering their marketplace. In China, however, foreign entities establishing a presence in China for the first time are able to compete with domestic enterprises on a relatively even playing field. The social credit system benefits the business that is willing to take the system as it is and maximize their potential under its jurisdiction, instead of simply favoring the home-grown organization.

As discussed earlier in the article, it is often in the best interest of foreign businesses to partner with a local expert to ensure that they provide the proper information to local authorities during the process of registering their business process. Part of this procedure includes performing an internal audit to make sure that the business is compliant with all necessary regulations.

GlobalizationPedia is an advanced PEO matching tool that can help businesses expanding into China connect with a top-rated China PEO to ensure full compliance with the social credit system and capitalize on the unique business opportunities available in China. Fill out the form below today to receive a customized proposal for the best PEO for your organization’s needs.

How useful was this post?

Click on a star to rate it!

Average rating 4.8 / 5. Vote count: 333

No votes so far! Be the first to rate this post.